DATE: 07/06/2017

Recommendation: BUY Hold -3 years

Target: 150 Rs

Target: 150 Rs

By Kamlesh Bavrva

Company Name: North Eastern Carrying Corporation Limited

BSE Code: 534615

NSE Code: NECCLTD

CMP: 52

Market Capital: 261

Cr.

Face Value: 10

52 Week Low / High:

31/111

Book Value: 15

Price/Book Value:

3.33

Dividend Yield (%): 0

NECC

at Glance:

v NECC is among top freight forwarding

companies in India and one of the best Goods Transport Agencies in India.

v NECC

is having own 150 trucks with GPS tracking facility.

v NECC has proven capabilities in Part Truck

Load (PTL) and rail logistics for all types of materials and well entrenched

reliable network across India - able to execute individual business needs in an

efficient and cost effective manner

v NECC

Caters to Industrial, MNCs and highly regarded entities’ requirement to freight

their critical materials throughout as well as outside India.

NECC is equipped with specialized

subsidiaries like…

v NECC Logistics – A

dependable logistics Partner,

v NECC Telecom – Up-to-date

Logistics for competitive Telecom Sector &

v NECC Packers & Movers

– Smart Packing & Moving Solutions

Part 2 - NECC Shareholding Pattern:

North Eastern Carrying Corporation Ltd - Share

holding Pattern

|

||

% Share holding

|

% Share pledged

|

|

Shareholding

of Promoters & Promoters Group

|

67.52

|

Nil

|

Public

holding

|

32.48

|

|

Total

|

100

|

|

v NECC was

existing having 400 Cr order from Tata Steel and got 50Cr order again from Tata

Steel for transportation of their raw materials and mining prodcuts from Joda

and Sukinda mines to the Company’s factories situated in Odhisha which to be executed

over 4 years by the company. Total order book is 450 Cr.

v NECC has earlier worked with

Rungta Mines Limited in Joda, Odisha and MSPL Limited in Hospet, Karnataka for

mining products.

v Partial

truck load Sundry Movement, now contributes 49% of revenues

v Full truck

load grew by 29% during the year

v Planning

to Increase warehousing space from 1.5

Million sq feet

v Continued

focus on improving profitability by moving away from non-profitable clients

Office and

Warehouse:

Booking offices across the country and Nepal,

servicing multiple routes with warehousing

v 250 offices across 28 states and 4 countries-

India, Nepal, Bhutan and Bangladesh

Warehousing of 1.5 million sq feet - includes

owned and leased under management

v Warehouses are multipurpose catering to Bulk,

FMCG, Holding Intermediates, Steel, amongst others

v Access

to 1.5 mnsq of open warehousing – 50% owned & 50% leased

v Emphasis

on increasing open warehousing capabilities through lease

v Flawless

Logistics Management Solutions backed by dependable warehousing and

3PL-services based on advanced trouble-shooting capabilities

v NECC

is providing logistic service for

v Small

consignments retail booking

v Bulk

movements

v Project

Over dimensional consignment (ODC)

v Containerized

movement of cargo

v PTL/Parcel

load movement

v Full

truck load services

v NECC working with leading companies in the

FMCG, Paper, Pharma, Automotive, Textile, Chemicals, Steel and Telecom sector

v Exclusively working with a leading FMCG - MNC

Company for transportation of its goods in Nepal

v NECC is offering various kind of commercial,

Industrial & Residential freight not only within the India but also in

Nepal, Bhutan and Bangladesh with additional services like 3PL &

warehousing solution.

v NECC provide a broad range of freight

management and customized logistics solution backed by automated ERP based

software

v The Company provides carriage of FTL (Full

Truck Load) for clients including big giants of FMCG, beverage and electrical

industries

Part 4 - Operational

Outlook:

v The

Company’s strategy is well thought of and in line with domestic market trend

and industry.

v The

Company is growing its traditional parchoon market and simultaneously spreading

and picking the FTL market segment.

v The

Company is broadening and condensing its market throughout the Indian

subcontinent, Nepal and Bhutan.

v The

Company had reported turnover of Rs. 539.75 Crore (approx.) in the financial

year 2015-16 as compared to Rs. 531.93 Crore (approx.) in the financial year

2014-15 through its 200 (approx.) branches and 800 employee base.

v Hired

vehicles contribute to 95% of business and 150 own trucks contribute to 5% of

business

v Top 5

customers contributed 20% of total revenues in FY17 and 22% in Q4FY17 vs 13% in

FY16 and 27% in Q4FY16

Q4FY17 consolidated:

v Revenue

at Rs. 142.02 crore down by 3.14% over Q4FY16 Rs. 146.63 crore.

v EBITDA

at Rs. 5.52 crore vs Rs. 6.70 crore in Q4FY16, margins at 3.9% • PAT at Rs.

1.50 crore down by 24.62% over Q4FY16 Rs. 1.99 crore • EPS at Rs. 0.3 per share

not annualized

v Revenue

at Rs. 548.69 crore up by 1.66% over FY16 Rs. 539.75 crore

v EBITDA

at Rs. 19.76 crore vs Rs. 21.32 crore in FY16, margins at 3.6%

v PAT

at Rs. 5.60 crore down by 0.71% over

FY16 Rs. 5.64 crore

v EPS

at Rs. 1.12 per share

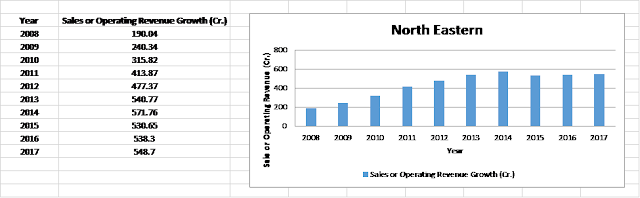

Financial Chart:

Part 6 - OPPORTUNITIES & THREATS:

v Historically,

road freight in India has increased since its 1950–51 level of 6 billion tone

kilometers (BTKMs) to 1,086 BTKMs in 2009–2010, witnessing a CAGR of 9.21

percent during this period.

v By

assuming a GDP of 9.0 percent, implying a freight CAGR ~ 9.6 percent in future,

the market scenario will be uncertain in future, can give the uncertainly in global

and domestic economies.

v The

resulting road freight opportunity is estimated to 2,000 BTKMs in 2016– 17.

v As

said above, the Indian Road transport industry is on a tremendous growth path

which leaves many opportunities and threats which determine the Company’s

growth:

Opportunities:

v Increased

demand of 3PL (third party Logistics).

v The

improving infrastructure and rising focus on core business operations will lead

the future growth of the Indian 3PL.

v Infrastructural

Development Investment policies of Central & State governments shall result

in higher growth opportunity for transportation business.

v Expected

increase in freight during 2010-2020.

v Successful

completion of National Highways Projects

v The

satellite watch over fleets through GPRS system shall also enhance the timely

and prompt delivery of consignments to the prospective clients.

v ERP

system under development shall, after its installation, improve the quality of

documentation, records, billings etc.

Threat:

v Competition

from local and multinational players.

v Damages,

accident and theft are matter of concern during voyage.

v Natural

disturbance inform of floods, cyclone, landslides in major parts of India.

v Due

to above conditions, the claims from clients increases and inflow of revenue

decreases and finally resulted into long legal litigation.

Part 7 - RISK MANAGEMENT:

Competition Risk:

v This

risk arises from more players wanting a share in the same pie. Like in most

other industries, opportunity brings with itself competition.

v Different

levels of competition in each segment, from domestic as well as multinational

players. However, NECC has established strong brand goodwill in the market and

a strong foothold in the entire logistics value spectrum.

Regulatory Risk:

v Delay

to obtain required approvals and licenses in a timely manner, business and

operations may be adversely affected. However, the Government has come up with

a number of initiatives to boost the logistics sector and has planned massive

investments in the infrastructure sector.

Liability Risk:

v Risk

refers to liability arising from any damage to cargo, equipment, life and third

parties which may adversely affect company business.

v The

Company attempts to mitigate this risk through contractual obligations and

insurance policies.

Part 8 - About GOOD & SERVICE TAX (GST):

v The

Government of India has been taking several steps to rationalize the tax

systems in the country. Among the major initiatives of the past being the

introduction of Value Added Tax (VAT) System.

v Subsequent

to the success of the VAT regime, the Government embarked on efforts for

implementation of a much more refined and globally preferred tax system known

as Goods and Services Tax (GST) in 2007.

v GST

is defined as a ‘nationwide uniform taxation system’ which replaces multiple

taxations by central and state governments in a country.

v The

concept is that a specific product or service would have the same level of

taxation across the entire country irrespective of being manufactured and sold

in different sub-national territories (states).

v Across

the world, GST is the most popular trade tax regime practiced by over 150

countries.

Benefits to Logistics Sector:

Due to GST

v Centralization

of inventory into larger regional warehouses

v Move

from Local to regional distribution (service levels to areas outside major

distribution centers will have to improve)

v Shift

to larger full truckload movements servicing inventory transfers to the larger

warehouses

v Improved

travel speeds due to reduction in regulatory delays.

Part 9 - Key drivers for company Growth:

v GST

to have a positive impact on NECC for reducing time translating to better asset

sweating

v Warehouse

consolidation to help efficiently transport goods directly from factory to

point of destination

v Increasing

focus on setting up Hydro power stations in North East and Bhutan will augur

well for NECC

v Proposing

to become a multi modal player with presence in air freight

v Increasing

open warehousing capabilities thereby offering effective service under one roof

v Growing

focus towards the 3 PL (Third party logistics) segment which is presently under

serviced

v Asset

light model - large proportion of warehouses leased and vehicles hired

Part 10 - Investment Rational:

1.

Positive impact on company business

due to suspecting GST implication from 01/07/2017.

2.

Company will finished the Sukinda mine

150 Cr order by December 2018 which will impact on company profit.

3.

Increased Revenue at Rs. 548.69 crore

up by 1.66% over FY16 Rs. 539.75 crore

4.

PAT at Rs. 5.60 crore down only by 0.71%

over FY16 Rs. 5.64 crore which is good indication that company is maintaining

constant healthy profit.

5.

Company is investing working capital/

profit in Capex for business expansion and due to that company is not paying

dividend.

6.

Company more focus on third party logistic service

(3PL) and Air freight.

7.

Strong vision of Promoter Group

v Peer

Company’s stock is running on higher value and this stock is still available at

cheaper price.

v Stock

CMP is 51 Rs. and stock is trading at P/E 45 & EPS 1.1, Based on above all

points stock may touch 150 Rs. within a 3 years’ time horizon.

Please note:

Note: The

articles are not research reports but assimilation of information available on

public domain and it should not be treated as a research report.

Registration status with SEBI: I am not registered with SEBI under the (Research Analyst) regulations 2014 and as per clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”

Disclosure: It is safe to assume that I might have the discussed companies in my portfolio and hence my point of view can be biased. Readers should consult registered consultants before making any investments.

Registration status with SEBI: I am not registered with SEBI under the (Research Analyst) regulations 2014 and as per clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”

Disclosure: It is safe to assume that I might have the discussed companies in my portfolio and hence my point of view can be biased. Readers should consult registered consultants before making any investments.

No comments:

Post a Comment